BLUF: Servicemembers Mortgage Rate Relief:

- If members have to transfer (to a new duty station, out of service, or retiring) and they own a house, they have to sell the house then buy a new one.

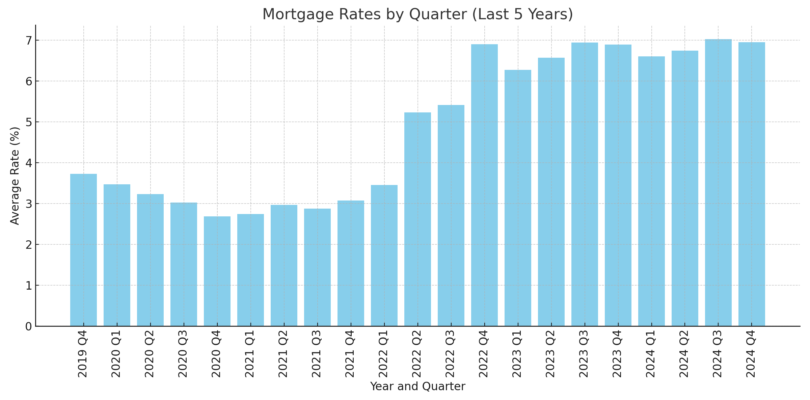

- Now say the member has an interest rate of 3% on their mortgage. But the federal rates have risen to 6.5%.

- The service members should be permitted to carry over that 3% Mortgage Rate rather than having to take the new rate increase for their new house.

- This should continue to carry over in perpetuity.

This shouldn’t carry over nor be eligible IF:

- Their credit rating takes a major hit. (>100 down from all 3 credit agencies) Details will be important here.

- They are getting anything but an Honorable Discharge. This will pertain to transferring back to Civilian life either by Retirement or EAOS.

- There is a break in ownership: (Own then Rent, then own again.)

- The property type cannot change. It must be a residential type of home. Condo, Townhouse, Single Family, or even a manufactured home. You cannot go from a residential to say an office building.

- It must be the same type of loan. VA Loan, 15 Yr, 30 yr, fixed rate, etc. Variable Rate not eligible.

What I need from you:

- A letter. Preferrable typed. Need a signature though. You can scan it and email it to me or mail it via USPS.

- Email: admin@navycrf.com

- Address: Please ask if you want to mail it.

- The letter should be formal and the greeting should be:

- “To the Senate and House of Representatives of the United States:“

- The letter needs these questions answered:

- Have you ever had to sell a home to PCS?

- If yes, did you buy a home at your new duty station/retirement/EAOS?

- Did that home come with a higher mortgage rate?

- What were your monthly payments?

- Was your BAH higher/lower than your previous station?

- Did the increased Mortgage Rate affect your housing decision?

- Was your new home smaller or larger than the previous home?

- How much did the LOWER housing allowance affect your housing decision?

- Overall, how did increased mortgage rates affect your family quality of life?

- Have you ever had to sell a home to PCS?

I’ll need you to tie this all together. Be honest but do not sugar coat it either. I’m really looking for people who had to take an increased mortgage rate at their new duty station, where they retired to, or where they ended up at after EAOS.

Outside of the Letter Questions:

Do you know of any programs in which service members get relief on interest rates?

What challenges do you foresee this program could bring and how would YOU address that.

I’ll also be looking at Veteran Housing Assistant Programs to get some information on foreclosed service members to see if that ended with them being homeless.

The Downside:

I know this is a big ask/project. But I think this is a cause worth fighting for. And I’ll need all of your help. One MAJOR argument against this is this may have unintended consequences. Such as Banks not wanting to take a mortgage at a loss so they won’t provide mortgages to Service Members.